CaSys AD Skopje is a company established in 2001 as the first and only processor in the Republic of North Macedonia, which, in addition to the domestic market, also grows into a certified processing center in the region.

The main activity of CaSys AD Skopje includes processing transactions with payment cards, management of ATM and POS network, e-commerce, personalization of debit and credit cards and non-payment cards as well as services of the duty center.

In the field of e-commerce, CaSys AD Skopje is a trusted partner of the banks with which they meet the set goals and plans, currently directly cooperating with three domestic banks (Komercijalna Banka, Stopanska Banka and Uni Banka).

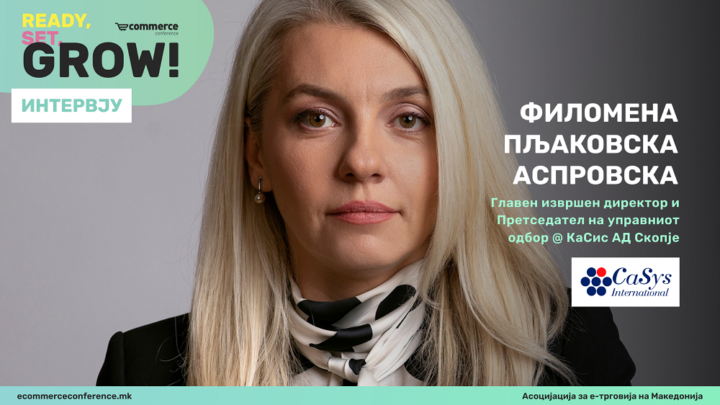

We are talking with the Chief Executive Officer and President of Management Board of CaSys AD Skopje, Ms. Filomena Pljakovska-Asprovska, on the topic of e-commerce, with special reference to global trends in this field, the new draft law on payment services and the change of amount on replacement fees, security which is one of the key aspects for the development of e-commerce as well as the companies’ response to the challenges posed by the Covid-19 pandemic.

The 4th annual conference on e-commerce is held on November 12, and CaSys AD Skopje as the only processor on the territory of Macedonia is one of the golden sponsors of the conference. How do you see the development of e-commerce in the country and globally, what are the global trends and in what direction they will develop, what novelties can we expect when it comes to e-commerce and payment innovations?

With pride and satisfaction CaSys is again, this year, a golden sponsor of the 4th conference where we expect sharing of experiences, novelties and future important projects related to the growth and development of e-commerce.

The trends and habits that were stimulated by the pandemic, increased the number of e-shops, increased supply, increased the number of e-commerce transactions. As expected, they continue to develop this year as well.

This year, the same as in 2020, the Asia-Pacific and North American regions lead the global e-commerce sales rankings. China’s strong influence contributes to the Asia-Pacific region accounting for 60.8% of worldwide e-commerce sales in 2021, with North America accounting for 20.3% and Western Europe 12.6%. After a global growth of 25.7% in 2020, to $ 4.213 billion, this year the sales worldwide are expected to rise by an additional 16.8%, to $ 4.921 billion.

The Macedonian market follows the global trend. Compared to June 2020 – June 2021, the number of transactions at online points of sale increased by 21%, and the value of transactions increased by 61%, ie from 274 million denars to 443 million denars. Of course, this is also a result of the growth in the number of virtual points of sale, which has increased by 36%, from 1,223 to 1,661 virtual points of sale.

According to official statistics, the number of transaction accounts of individuals in commercial banks is 3.82 million, which is 95% of the total number of open transaction accounts and is an excellent prerequisite for growth in the number of issued cards and other electronic instruments as one of the important factors for e-commerce.

The constant growing trend of payment cards is significant from the aspect of development of new payment models as the globally very current “buy now-pay later” function which is aimed at providing convenience and optimal management of customers’ own finances for lower costs. What is emphasized is the improved user experience, the reduction of the shares in which the buyer is involved and still maintaining a high level of security and authentication with highly sophisticated methods. The card digitalization and the issuance of virtual cards and transfers are especially relevant.

In Macedonia, according to the new law on payment services, there is finally an opportunity for new players on the payment market, i.e the entry of fintech companies that will offer new payment methods. How do you see this possibility, will it increase the competition in the payment industry and what new payment methods do you expect to appear after this law comes into force?

The harmonization of the national with the European legislation in the field of payment services and payment systems is inevitable and necessary. The National Bank of the Republic of North Macedonia together with the Ministry of Finance, during 2020 and 2021, held and organized many twinning conferences on the topic. The goals are clear and we as a company are supporters of this legal framework that will enable the entry of new payment service providers in the domestic market, which would lead to increased competitiveness and efficiency in the payment sphere and would encourage the process of digital transformation of payments.

CaSys became part of the elite Berlin Group in August 2021 and has the opportunity to offer its knowledge and human potential in the development of digital payment channels.

In the past period, we actively participated and were maximally transparent through financial inclusion and education to be always available and to provide timely information to both payment card users and e-traders.

Interchange fees for cash card payments will be gradually reduced with the ultimate goal of reducing the costs charged to citizens and companies. Can you explain to us exactly what the interchange fees are and what is the direct connection between these costs and the cost charged by the end users?

The interchange fees are set by the operators of the payment card schemes, such as Visa /MasterCard. Whenever a consumer uses a credit or debit card in business, physical or online, the acquiring bank pays the so-called “interchange fee” to the issuing bank. This fee is part of the total operating costs of the traders, and is directly related with a card when the payment is made.

The new law will bring increased transparency about the amount of individual costs that are included in the price paid by the buyer. It will provide comparability of fees for payment services and the opportunity to choose the most favorable payment service provider. The peculiarity is that the law introduces a limitation of the replacement fees with payment cards, and for certain categories of consumers it will be possible to open accounts with basic functions through which a certain number of free payment transactions can be performed.

What is your stance on this issue, will the reduction of the interchange fees really reduce the price of the services (transaction fee) intended for citizens and companies or will they be compensated by introducing other fees? What are the regional experiences regarding this issue?

The regulation will undoubtedly bring significant benefits to consumers and traders, reduce certain costs and increase transparency. We should not forget the fact that the processors, banks, issuers / servers of international cards have made large investments and are continuously investing in improving the services. I am convinced that with joint efforts all entities in the financial sector will find the right solutions.

The new players whose appearance will be enabled by the new law will also impose costs on the users of their services due to the investments that will be made to enable them. Increasing competitiveness and new innovative services are the ultimate benefit for customers and for the positive development of payment services as a whole.

Security is one of the key segments that contribute to the further development of e-commerce. The Association for e-commerce on the topic of security with the help of the five banks that offer e-commerce has developed a register of e-traders, and additionally issues the certificate “verified e-trader” which is obtained if a certain e-shop meets the basic legal regulations, which determines the reliability and security of the e-trader. On the other hand, you as a processor also have a significant role to play in terms of security (through 3-D authentication and certification by MasterCard, Visa as well as PCI DSS standardization). How important are these segments and how they contribute to a better climate for e-commerce development?

Let me congratulate the project – Register of e-traders and issuance of the certificate – “Verified e-trader”. CaSys is a supporter, promoter, initiator of security as an important segment in the development of e-payments. We must emphasize that the Republic of North Macedonia has a safe, secure, trustworthy and resilient digital environment, supported by well-built facilities, highly qualified experts, a built-in level of trust, and national and international cooperation in the field of cyber security. The CaSys cPay system and complete infrastructure are continuously compliant with the latest requirements of international standards. We comply with the latest requirements for the 3D security model of MasterCard and Visa networks. As I mentioned, we are working on implementing and providing a high level of security and authentication with a minimum of activity by the buyer.

What is inevitable and what we are continuously working on is the education of the population. We are active by publishing educational texts, participating in forums and events that cover topics in the field of e-commerce, blog texts, etc. In order to have a successful and secure e-commerce that will constantly grow, in addition to the benefits to customers, we need to be constantly helping for a positive online experience.

E-commerce in the country and globally is growing, especially with the outbreak of the pandemic with Covid-19. But we are witnessing that although things are slowly returning to normal, the growth of e-commerce is not slowing down. You as a payment processor that works directly with three banks that offer e-commerce, in your portfolio are witnessing this growth and the growing number of new requests for e-shops. Tell us what are the most common requirements, whether these are businesses that have been most affected since the Covid-19 pandemic started or whether all businesses are already aware of the benefits of e-commerce and strive to implement it as an integral part of their operation.

I could not single out an activity or business that worked most actively on the development of e-commerce. But what makes me especially happy is the fact that many businesses have developed that operate only online, without physical stores. Supermarkets and stores for healthy food, restaurants and delivery of prepared food, cosmetics, clothing and sports equipment, household appliances, and everything else. The fact is that companies are constantly investing in their online stores, making improvements, from which we conclude that the benefits and advantages for all participants are great.

For service providers but also for retailers who also have physical stores, this is an important additional channel for payment, placement of products and services, faster and easier communication with customers and real competition in the physical store.

It is evident that the pandemic has fueled trends and created habits of increasing need for electronic services and online shopping. The CaSys team is working hard to ensure that all prerequisites for these trends are maintained and that e-commerce continues to move upwards. We have been working on the development of e-commerce since 2007, during which we rushed and started a journey together with the banks, finding solutions related to electronic payment channels. We have given maximum support in the field of e-commerce, for which I am especially proud of the management of CaSys and our entire team.

This year we celebrate 20 years of existence and I believe that our customers see us as a trusted and secure partner for business development and digital transformation, top security in our card payment solutions, a source of advice, experience and knowledge. We continue together to even greater challenges and successes.